Customs Dagang Net. Explanation of Government Tax Codes For Purchases Explanation of Government Tax Codes For Supply Previous Post Next Post.

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

PwC 20162017 Malaysian Tax Booklet CONTENTS Type of supplies Supply of goods and services Relief from charging or payment of GST Special schemes Free Zones Designated areas Recovery of input tax Time limit for making claim of input tax Tax invoice Records and retention period Returns Penalties Other Duties Import duties Export duties Excise.

. 7 Singapore 7 Vietnam 10 Indonesia 10 and Philippines 12 5In Europe the rate of GST or VAT is between 16 and 25 and accounts for nearly 8 of total GDP. Implementation of New Customs Harmonised System HS Codes 2017 Centre For Professional. No guide to income tax will be complete without a list of tax reliefs.

GST code Rate Description. GST on purchases directly attributable to taxable supplies. 12017 Date of Publication.

All imported services acquired for the purpose of business except exempt supply of services will be subject to GST. TAX CODE 1 Government Tax Code There are 23 tax codes in GST Malaysia and categories as below. 1A The total amount of gross income referred to in subsection 1 where applicable shall include any amount of output tax paid under the Goods and Services Tax Act 2014 in connection with the gross income which is borne by the employer.

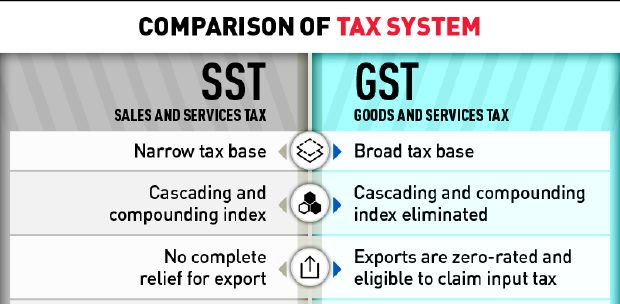

At the suggested initial rate of 4 Malaysia would be charging the lowest GST in the region Thailand. The Goods and Services Tax GST is an abolished value-added tax in Malaysia. GST on supply of goods and services Output Tax business purchases Input Tax Net GST Payable to the Director General of Customs Refundable from the Director General of Customs INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART I EXPENSES Public Ruling No.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. TaXavvy Issue 7-2017 2 Public rulings on income tax treatment of Goods and Services Tax The Inland Revenue Board IRB has recently issued Public Ruling 12017 Income Tax Treatment of Goods and Services Tax GST Part 1 Expenses PR 12017 and Public Ruling 22017 Income Tax Treatment of GST Part 2 Qualifying Expenditure for Purposes of Capital. RM415b collected from GST in 2017 RM415b collected from GST in 2017 By NST Online - October 27 2017 118am File pix The federal government expects to collect RM415 billion in Goods and Services Tax GST in 2017 07 per cent higher than 2016s RM4121 billion.

Supply of handling or storage services. Malaysia Master GST Guide 2017 provides a clear concise and practical explanation of Goods and Services Tax GST in Malaysia. This article relates to the Goods Services Tax which was introduced in April 2015 but was subsequently replaced with the Sales Service Tax in September 2018.

Company GST Registration No. Jabatan Kastam Diraja Malaysia Appendix 2 - Guide to enhance your accounting software to be GST Compliant Draft as at 13 March 2014 TX. 8 JUNE 2017 INCOME TAX TREATMENT OF.

Recommended Tax Codes for Goods Services Tax. Responsibilities Rights of Individual. B the income tax adjustment made to the QE of a capital asset if the asset is.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. It is envisaged the current hs codes for zero-rated goods under the gst zero rated supply order would be amended accordingly to reflect the new 10-digit hs codes andor products. The supply of services directly in connection with goods for export to an overseas customer ie.

The GST on imported services is payable by the recipient of the GENERAL GUIDE As at 24 AUGUST 2017 2 services using the reverse charge mechanism. And Export declarations and products affected under Goods and Service Tax. GST Tax Codes for Purchases GST code Rate Description TX 6 GST on purchases directly attributable to taxable supplies.

Malaysia GST Tax Codes Tax codes determine how much tax is due for each transaction line item. HS 2017 in Malaysia. Goods and Services Tax GST in Malaysia The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6.

GST Tax Codes for Purchases. Malaysia GST Reduced to Zero. Chargeable Income Your chargeable income is best illustrated with an example like so.

INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART II. In favour of the FMM INSTITUTE. While the 28 tax rate for non-residents is a 3 increase from the previous years 25.

The current hs code for trade samples 980000 600 will be changed to 98000000 60. The RMCD has recently issued the Relief by Minister of Finance 12017 in relation to the following group of supplies. For more information regarding the change and guide please refer to.

GST tax codes rates. Goods are identified by a 10-digit code instead of 6-digit codes eg. Pix by HAZREEN MOHAMAD.

This book is an invaluable tool for tax advisers and accountants in public practice as well as those in the. The below reliefs are what you need to subtract from your income to determine your chargeable income. Allowances includes the goods and services tax GST paid or to be paid.

Section 13 of the principal Act is amended by inserting after subsection 1 the following subsection. The existing standard rate for GST effective from 1 April 2015 is 6. For more information on tax codes see Tax Code Properties and Creating Tax Codes.

For NetSuite to calculate correct values on transaction records and tax reports you must ensure that the tax codes for Malaysia are set up correctly. IM 6 GST on import of goods. March 31 2017 475427-W Perak Attn.

Goods And Services Tax Gst In Malaysia 3e Accounting

Goods And Services Tax Gst In Malaysia 3e Accounting

Gst And Service Tax On Secondment Of Employees Taxmann Blog

Newsletter 10 2018 Gst Tax Codes Part 2 Page 001 Jpg

Newsletter 9 2018 Amendment On Gst Tax Codes Page 002 Jpg

The Brief History Of Gst Goods And Service Tax Goods And Services Goods And Service Tax Raw Dog Food Recipes

Checkout The Gst Rate Chart 2017 Now Here At Taxguru Find Out The The Changes Made By Gst In India Chart Rate Goods And Service Tax

Tax Invoice Goods Services Tax Abss Accounting Malaysia

Gst Better Than Sst Say Experts

Tax Codes In Myob Goods Services Tax Malaysia

A Complete Guide On Gst Rate For Apparel Clothing And Textile Products

Newsletter 24 2018 Reduction Of Gst Tax Rate To 0 Page 001 Jpg

Goods Services Tax Gst And The Current Price Increases In Malaysia Artha Nyana Malaysia

Goods And Services Tax Gst Gpi

Gst Better Than Sst Say Experts

Tax Codes In Myob Goods Services Tax Malaysia

Countries Implementing Gst Or Vat